Growing and Protecting Your Finances

Once young people have established a financial base, ensuring their money is protected is key to financial stability. Give your students the tools to understand how to invest responsibly to grow and protect their finances.

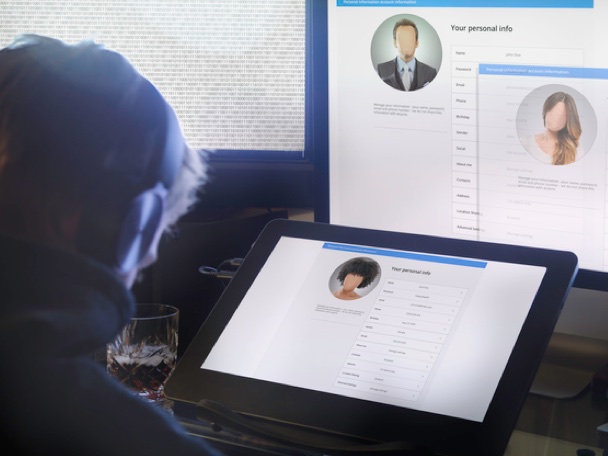

Helping Loved Ones Avoid Identity Theft and Other Financial Abuse

This guide will help parents discuss the risks of identity theft and scams with their teens. They will also find information on helping their teens safeguard against identity theft.

Understanding Investing Options

Help explore the various investing options and the relationship between risk and reward in investing.

Understanding Investing Options

In this module, your students will explore different types of investments (stocks, bonds, mutual funds, and money market account) and the possible risks and rewards of each.

Supplemental Resource Links

Increasing the Value of Your Money

Help students understand how investing can help them meet long-term financial goals and build wealth over time. This lesson invites students to research and evaluate investment vehicles and explore how investments are regulated.

Investing

This complete unit plan includes lessons, activities, projects, and case studies on investing including stocks, bonds, and mutual funds. (To access these resources, you will need to register for a free account and verify that you are an educator.)

Discovering the Benefits of Investing Early

In this activity, students use an online calculator to compare investments for three fictional investors. In doing so, they learn about the value of investing early.

Financial Markets

This four-minute video explains how people make—and lose—money through investing. Stocks, bonds, mutual funds, and exchange-traded funds are explained.

STAX

In this investing game, students make decisions as they allocate their savings between a variety of investment options and learn about each investment as they go. Students can play independently or compete against each other. A reflection worksheet is also provided.

Crypto Craze

This game provides students with the chance to learn about cryptocurrency. Through the game and accompanying worksheet, students learn just how volatile crypto can be.

Building a Diversified Portfolio

Students explore the need for having a diversified portfolio and then work individually to create a portfolio with at least 10 companies from three or more sectors.

Building a Diversified Portfolio

Learn about the different risks associated with investing in stocks, bonds and mutual funds, and discover ways to build a diversified portfolio that balances risk based on their risk tolerance, timeline, and purpose for investing.

Build Your Own Portfolio

After brainstorming a list of brands and companies with which students are familiar, they work in small groups to categorize companies by sector. Students discuss the need to have a diversified portfolio and then work individually to create a portfolio with at least ten companies from three or more sectors.

Supplemental Resource Links

Diversification and Risk

In this lesson, students work with a portfolio of investments and assess the risk associated with the products in their portfolios. They later determine which savings and investment instruments might be most suitable for clients of different ages and economic status.

Diversification

An infographic shows how diversification works. Examples demonstrate the difference between an aggressive and conservative portfolio.

The Stock Market Game

In this stock market simulation, teams compete to grow a hypothetical $100,000 portfolio. Registered teachers can access lesson plans and support materials, and students can participate in the InvestWrite essay contest.

Index Funds

After reading this article, students should be able to explain what index funds are and how they help investors diversify.

What the Heck Are Mutual Funds?

This video explores how mutual funds work and the built-in diversification they offer. Students will also learn about actively managed funds versus passive ones and the wide array of mutual funds available to investors.

Making Charitable Donations

Explore how people donate to charity and the tax benefits of donating.

Making Charitable Donations

Your students will investigate types of charitable organizations, how to make wise giving decisions, and the potential tax benefits of making charitable contributions.

Supplemental Resource Links

Pocket Giving: Charitable Giving

This lesson explores philanthropic giving, how to devise a spending plan to meet a giving goal, and what to do if you are the recipient of a gift. It also delves into charitable giving in non-monetary ways, showing students that giving extends beyond cash.

Giving to Others

Students learn that being part of a community can provide many financial and nonfinancial benefits. (To access these resources, you will need to register for a free account and verify that you are an educator. Once logged in, the link above will take you directly to the resource.)

Writing About Giving

In this activity, students use online research to identify a local charitable organization that interests them and write a persuasive letter encouraging others to support the organization.

50 Community Services Ideas for Teen Volunteers

This list provides 50 ways for your students to give back to their communities. Ideas include helping a nonprofit organization set up a social media account and mentoring children. The list also highlights some young people who have created their own organizations to help others.

Spent

Do your students understand the challenges faced by people with limited financial resources? This activity builds empathy in students by having them try to make ends meet for a month with $1,000 in savings.

Charity Navigator

Students can research and compare organizations to which they may wish to donate time or money.

Avoiding Financial Fraud

Help your students understand the different types of financial fraud and discuss the ways to prevent financial fraud and abuse.

Avoiding Financial Fraud

During this module, your students will get an overview of different types of financial fraud, including identity theft and investment fraud, and learn strategies to reduce risks.

Supplemental Resource Links

Consumer Skills

This complete unit plan includes lessons, activities, projects, and case studies that help students avoid becoming victims of financial scams and fraud such including identity theft. (To access these resources, you will need to register for a free account and verify that you are an educator.)

Preventing Fraud and Identity Theft

Check out CFPB’s activities related to fraud and identity theft. Each takes a different approach, including investigating different types, examining statistics, researching consumer protection, and how to report fraud.

Protect Yourself

This lesson explores identity theft, prevention strategies for protecting personal information, and the consequences of identity theft in different real-world scenarios. Students will learn about phishing, pharming, text message scams, employment fraud, and more.

Top 5 Biggest Financial Scams

With this video, students learn about common investment scams including Ponzi schemes, pyramid schemes, pump-and-dump scams, IRS imposter scams, and phishing.

Getting Help with Financial Decisions

Your students will consider the role of various financial professionals as potential careers. They will also learn how to choose a financial professional.

Getting Help with Financial Decisions

In this module, students explore different ways that people can get help making financial decisions. Students are asked to consider several financial topics and where they would turn for help along with exploring information sources and financial professionals to determine who they can trust.

Financial Job Fair

After brainstorming jobs that help people with various aspects of their lives, students consider the role of financial professionals. They work in groups to research accountants, financial counselors, insurance agents, personal financial advisors, and real estate agents. Students host a mock job fair with each group hosting a table with information about the job they researched.

Supplemental Resource Links

Professional Designations

Individuals offering to help consumers with their finances could hold one of over 175 professional designations. Students can research what designations such as CFP, CPA, and EA mean and what it takes to earn each designation.

Manage My Own Investments? Are You Kidding?

Reading this article will help students understand the benefits and tradeoffs of investing with help from a financial professional.

Robo-Advisor

Would you trust a computer to guide your investment decisions? This infographic provides an overview of robo-advisors and a chart of pros and cons for using a robo-advisor.

What Do Financial Experts Do?

In this video, students learn about professionals who can help them with their finances, including accountants, insurance agents, lawyers, and financial advisors as well as mentors with experience in specific areas.

Start Here, Go Places

This site provides resources for both teachers and students on the field of accounting and what it takes to become one. It includes videos, virtual field trips, lesson plans, and more.